Whether you want to buy a house, travel the world, save for your child’s education, or retire early, financial goals give your money purpose. But life doesn’t stand still—and neither should your financial plan. In this article, we’ll break down how to define short- and long-term goals, create an action plan, and adapt your finances as life changes.

How to Define Short-Term vs. Long-Term Financial Goals

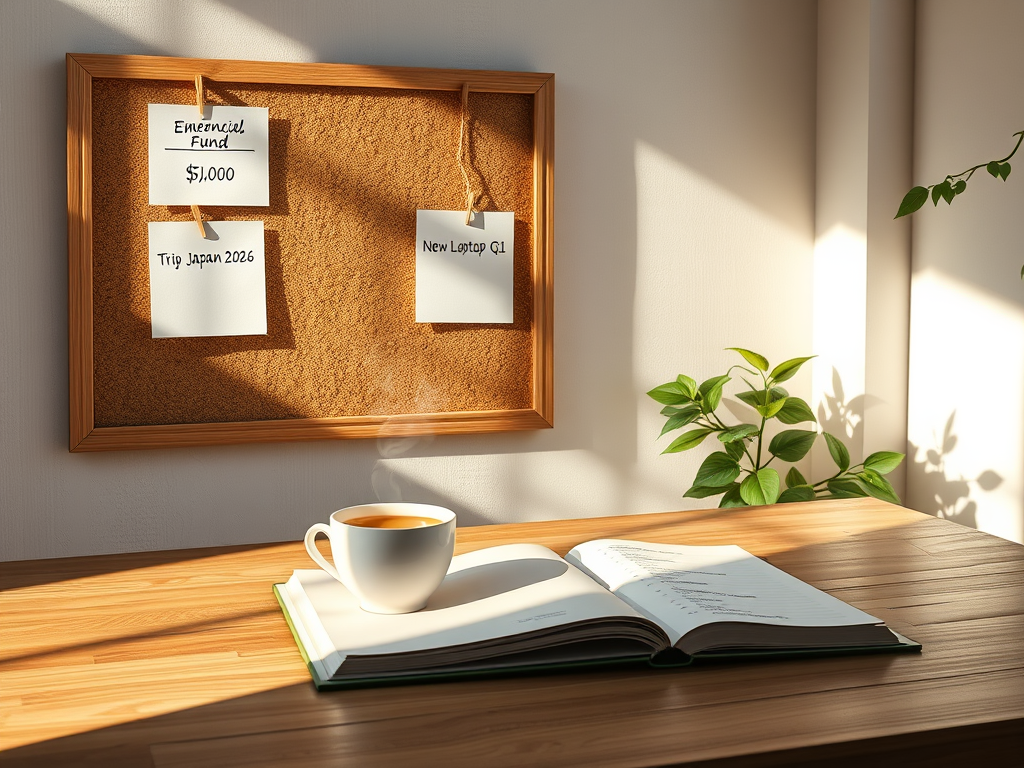

To succeed financially, it’s important to define your goals clearly and categorize them based on time horizon:

Short-Term Goals (Next 1–3 Years):

- Building an emergency fund

- Paying off credit card debt

- Saving for a vacation

- Buying a new laptop or upgrading your home office

Long-Term Goals (3+ Years):

- Buying a home

- Saving for children’s education

- Investing for retirement

- Starting a business

When defining goals:

- Be specific: “Save $5,000 for emergency fund” is clearer than “Save money.”

- Make them measurable and realistic.

- Give them a deadline.

- Align them with your values and life vision.

Creating an Action Plan to Achieve Your Goals

Setting goals is the first step, but turning them into reality requires a step-by-step action plan:

- Prioritize Your Goals – You may have multiple goals. Decide which are urgent or most aligned with your current stage in life.

- Break Them Down – Divide large goals into smaller milestones. For example, saving $12,000 in a year becomes $1,000/month.

- Automate Your Savings – Set up automatic transfers to savings or investment accounts.

- Track Progress – Use budgeting apps or a spreadsheet to monitor your journey.

- Review Quarterly – Life moves fast—check in with your goals every few months and adjust if needed.

Remember, slow and steady progress builds confidence and momentum.

Adjusting Your Financial Plan as Life Changes

Life is full of changes—marriage, children, job shifts, or even unexpected events like illness or job loss. Being financially flexible is essential:

- Marriage/Partnership: Combine finances thoughtfully. Talk openly about debt, savings, and shared goals.

- Having Children: Update your budget for new expenses, consider life insurance, and start a college savings plan early.

- Career Changes: During job loss, focus on emergency funds. With promotions or new jobs, revisit your goals and increase savings.

- Unexpected Life Events: Build flexibility into your plan by keeping 3–6 months of expenses in an emergency fund.

Your financial goals should evolve as your life evolves—revisiting and revising them ensures they stay relevant.

The Bottom Line

Setting and adjusting financial goals is a lifelong process that empowers you to live intentionally and with peace of mind. By clarifying your short- and long-term goals, following a structured action plan, and staying flexible through life’s changes, you’ll be well-equipped to navigate your financial journey with confidence.

If you’ve found this article helpful and want to support my mission of creating educational content for financial freedom, please consider buying me a coffee at buymeacoffee.com/truejourney. Your support helps me continue to share accessible, practical advice for people navigating their finances with ADHD and beyond.